Auxier Report: Winter 2023

Winter 2023 Market Commentary

2023 was a year that saw the most aggressive interest rate hikes in decades as short rates reached 22-year highs. Negative headlines were driven by bank failures and geopolitical turmoil from wars in Ukraine and the Middle East. Yet, according to the department of commerce the US GDP grew over 3.3% for the fourth quarter and 3.1% for the year. Record fiscal infrastructure spending, high risk-free savings rates, reshoring of factories, supply chains, and full employment were a few of the positive inputs. The US market as measured by the S&P 500 Index was able to recover from a 19% decline in 2022, gaining 11.69% in the quarter and 26.29% for the full year. However, a 20% decline requires a 25% gain to break even. The S&P 500 finished the year with a price-earnings ratio of 23.6 times with a 1.44% dividend yield. In the fourth quarter the Federal Reserve (the Fed) signaled a shift in monetary policy due to moderating inflation trends which ignited a powerful rally in both stocks and bonds. Ten of the 11 S&P 500 sectors finished up in the fourth quarter with energy being the only declining sector. Oil stocks fell 7% in Q4 and were down 1.4% on the year. While stocks rallied in anticipation of multiple rate cuts in 2024, our research shows a strong economy and no real need to reduce rates. We are looking hard but are not finding a broad-based acceleration in earnings.

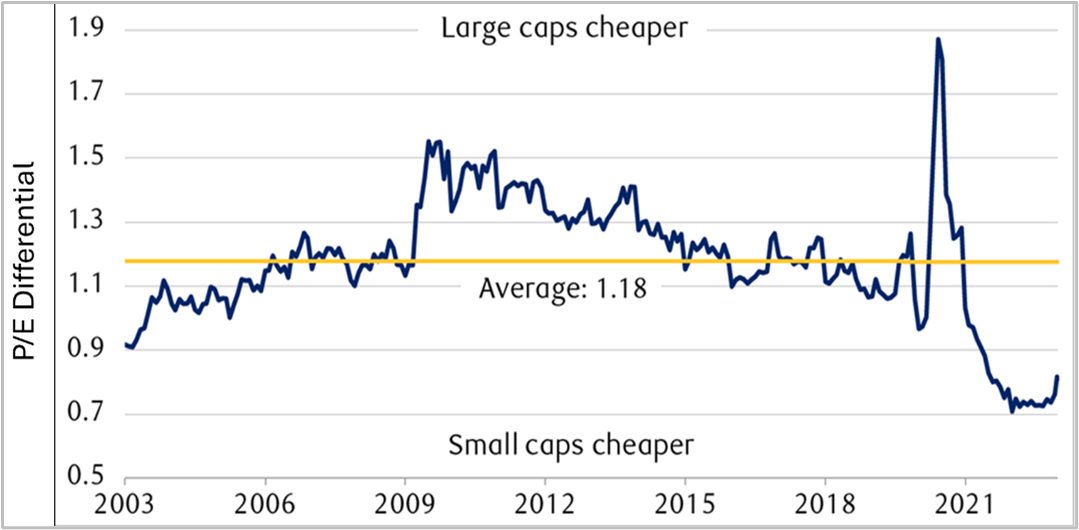

The rate cut fervor boosted speculative companies which outperformed defensive names. In addition, the excitement over weight loss drugs led to selloffs in food, beverage and medical devices. Healthcare trades at a steep discount to the market and lagged in 2023. Artificial Intelligence, cloud conversions, cost cutting initiatives and stock buybacks continued to be the story for tech businesses; those with scale, powerful network effects that are leaders in the digitization of the economy. It is often a “winner-take-all” environment. As investors crowd into mega-cap names, small-cap stocks are trading at a historically steep discount. According to RBC the gap in valuations for the S&P SmallCap 600 and S&P 500 is near its widest level in 20 years, as shown in this chart. RBC reported in January that the forward P/E of the S&P SmallCap 600 was 14.1x, which is below the 20-year average of 19.6x. According to Morningstar, as of the end of September the Auxier Focus Fund had a P/E ratio of 13.65. Over the years we have made it a habit to research and invest in a number of well-managed small and midsized companies. Many have turned out to be our biggest winners, like FirstService up 8400% over 20 years.

Electricity demand is surging due to the combination of energy-intensive technologies like AI and the push for electric vehicles. According to the Financial Times, $481 billion of industrial projects have been announced since 2021 with many being for the manufacturing of computer chips and electric vehicle batteries. In Northern Virginia, which has the world’s largest concentration of data centers, peak power demand doubled between 2018 and 2022. The largest utility in the region, Dominion Energy, expects electricity demand to grow 85% over the next 15 years, nearly five times faster than the growth over the previous 15 years. Rapid expansion of energy capacity will be required to sustain the increased demand that is expected to come from these new technologies.

Record Energy Production

Despite wars in Russia and the Middle East, oil and natural gas prices have plummeted. Even with OPEC cutbacks, record energy production out of Russia, Latin America, Iran and the US is helping to reduce energy costs, boosting the economy and consumer sentiment while lowering inflation. According to the Energy Information Administration (EIA), US crude oil production is projected to set records at 13.2 million barrels per day in 2024 and 13.4 in 2025. Oil prices were down an average of 17.82% in 2023 compared to 2022. US natural gas production is growing 1%-2% to over 105 billion cubic feet, a record. Prices declined 62% in 2023 from the average in 2022. Natural gas accounts for about 42% of power generated. Solar supply will rise with 36 gigawatts in 2024 and 45 gigawatts in 2025. Historically, recessions tend to follow parabolic increases in energy. Despite global geopolitical conflicts a contraction does not appear likely this coming year, a big positive for a consumer-led economy.

Value outperformed growth in 2022, but 2023 saw the balance shift back towards growth due to various factors like the artificial intelligence boom. The gap between the Russell 1000 Growth and the Russell 1000 Value in 2023 was 31.2 percentage points. This was also the third time in the last four years that the relative performance between growth and value has switched. In 2022, value had outperformed growth by 21.6 percentage points. The current trend towards growth has come due to significant investments in new AI programs and increased data center capacity. In a CNBC survey of top technology companies back in June, 47% of respondents said that AI is their #1 budget item for the next 12 months. Another factor that has impacted slower growth, dividend-paying stocks is higher short-term interest rates. A December 14, 2023 article from Investor’s Business Daily highlighted the difficulties that dividend stocks have been facing. The “Dogs of the Dow,” an investment strategy that holds the ten highest-yielding blue-chip stocks in the Dow, was up just 2.8% at the time of the article marking the biggest gap in performance relative to the S&P 500 since 2006. For the same period stocks in the S&P 500 that pay dividends were only up 0.81% while those that do not pay dividends were up 19%. Investors have been less incentivized to buy low valuation dividend-paying stocks when short-term Treasuries are nearly risk free and offering yields over 5%.

The Dominance of a Few Names Driving the Market

Over the last several years, indexes like the S&P 500 have become driven by an increasingly smaller set of companies. Out of the 503 companies in the S&P 500, index advances have been led by the “Magnificent Seven” which includes Apple, Amazon, Alphabet, Meta Platforms, Microsoft, Nvidia and Tesla. These seven stocks now comprise about 30% of the entire S&P 500, and according to Morningstar, they accounted for nearly 50% of the S&P 500’s overall gain in 2023. This chart from Apollo Academy shows how the size of these companies now rivals several countries’ entire equity markets.

Strong Pricing and High Interest Rates Boost Insurance

The insurance industry had a difficult start to 2023 as inflation and a higher-than-expected number of weather and climate events weighed on profitability. According to the NOAA National Centers for Environmental Information’s 2023 disaster report, there were 28 weather and climate disasters in 2023, up from a record 22 in 2020. Munich Re reported insured losses around $95 billion on the year, down from both 2022 and 2021. Hurricane Ian in 2022 alone led to insured losses of $60 billion. The second half of the year saw strong repricing for the insurance industry and Swiss Re estimates that global property and casualty premium growth during the year was 3.4%. In addition to rising prices, higher interest rates have boosted investment returns, specifically in the catastrophe bond market. Artemis, who tracks and analyzes the overall insurance-linked securities market, reported that the Swiss Re Global Cat Bond Index reached an all-time high return of 19.69% in 2023. This beat the previous best for the index which in 2007 recorded a 15.43% return. A chart from Artemis shows the growth of the cat bond index over time and highlights the drastic turnaround the market experienced in 2023.

The insurance industry is now in a better position with insurers focusing on tighter terms and conditions to improve underwriting profitability. More disciplined underwriting is leading to a healthier and more sustainable marketplace. Swiss Re is forecasting premium growth of 7% in 2024 and 4.5% in 2025 for the US property and casualty market.

Contributors

For the fourth quarter, financials were the best performing sector in the Fund, up 14%. Bank stocks continue to recover from the disruption they faced in March after the second largest bank failure in US history. Citigroup, Bank of America, Bank of New York, Central Pacific and Wells Fargo all posted double-digit returns for the quarter. The insurance sector continues to show solid fundamentals with strong premium growth and hard market pricing. This includes companies like Aflac, Arch Capital Group, AIG, Berkshire Hathaway, Aon, Marsh McLennan and Travelers.

Microsoft is the Fund’s largest holding and one of the strongest contributors, benefiting from the integration of artificial intelligence into the cloud. The company recently reported revenue of $62 billion, which beat analysts’ projections by about $1 billion. Azure cloud growth accelerated 30%. Another winner, Alphabet, has seen their cloud revenue increase by 26%. Google Search and YouTube continued to see steady growth, up 13% and 16% for the quarter and should benefit from the Olympics and election advertising demand. Travel continues to recover from the pandemic which led to 2020 becoming the worst year in tourism history. According to the UN World Tourism Organization (UNWTO), international tourism ended the year at 88% of pre-pandemic levels. Booking Holdings continued to recover from their drop with the stock ending the year up over 75%.

Detractors

The laggards for 2023 were in high quality healthcare and defensive staples. Health insurers UnitedHealth and Elevance were impacted by increased hospital utilization and rising medical cost ratios (although both are up over tenfold from our purchase price). Medical device, food and beverage stocks were hit due to headlines of the “Ozempic Effect.” This fear that weight loss drugs will lead to a material reduction in demand for these products has led to indiscriminate selling. However, CEOs from Abbott, Mondelez and McDonald’s, to name a few, have modeled the impact of the new weight loss drugs and are not projecting a material impact over the next five years.

Fourth Quarter 2023 Performance Update

Auxier Focus Fund’s Investor Class returned 7.19% in the fourth quarter 2023 and 9.75% for the year. The S&P 500 cap-weighted index returned 11.69% for the fourth quarter, while the equal weight returned 11.87%. The Russell 1000 Value Index gained 9.50%. Fixed income investments as measured by the S&P Aggregate Bond Index and the IDC US Treasury 20+ Year Index (4PM) returned 6.19% and 12.92% respectively. Smaller stocks as measured by the Russell 2000 gained 14.03%. Stocks in the Fund comprised 91% of the portfolio. The equity breakdown was 82.2% domestic and 8.8% foreign, with 9.0% in cash and short-term debt instruments. A hypothetical $10,000 investment in the Fund since inception on July 9, 1999 to December 31, 2023 is now worth $59,078 vs $53,808 for the S&P 500 and $48,427 for the Russell 1000 Value Index. The equities in the Fund (entire portfolio, not share class specific) have had a gross cumulative return of 956.91%. The Fund had an average exposure to the market of 82.0% over the entire period. Our results are unleveraged.

In Closing

There is a preoccupation with the Fed’s actions. It is like watching the referees at the Super Bowl instead of the players. We strive to spend our fundamental research effort digging deep to identify enterprises that have exceptional business models and a history of executing through the most challenging conditions. Execution is so important in today’s market. We are looking for management teams that have heart and soul, love the business, and are committed to the hard work and details necessary to enhance shareholder value. Artificial Intelligence is only as good as the quality and accuracy of the data. We are finding that we need to work harder than ever to uncover accurate facts and fundamentals.

Looking into 2024, a less restrictive Fed policy has historically been positive for equity markets. Between February 1, 1994 and February 26, 1995, the Fed raised rates by 3%. Then once they reversed, the equity markets rebounded and we enjoyed three years in a row of market gains exceeding 25% per annum.

We appreciate your trust.

Jeff Auxier

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by calling (877) 328-9437 or visiting the Fund’s website. Please read the prospectus carefully before you invest.

Fund returns (i) assume the reinvestment of all dividends and capital gain distributions and (ii) would have been lower during the period if certain fees and expenses had not been waived. Performance shown is for the Fund’s Investor Class shares; returns for other share classes will vary. Performance for Investor Class shares for periods prior to December 10, 2004 reflects performance of the applicable share class of Auxier Focus Fund, a series of Unified Series Trust (the “Predecessor Fund”). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds. The performance of the Fund’s Investor Class shares for the period prior to December 10, 2004 reflects the expenses of the Predecessor Fund.

The Fund may invest in value and/or growth stocks. Investments in value stocks are subject to risk that their intrinsic value may never be realized and investments in growth stocks may be susceptible to rapid price swings, especially during periods of economic uncertainty. In addition, the Fund may invest in mid-sized companies which generally carry greater risk than is customarily associated with larger companies. Moreover, if the Fund's portfolio is overweighted in a sector, any negative development affecting that sector will have a greater impact on the Fund than a fund that is not overweighted in that sector. An increase in interest rates typically causes a fall in the value of a debt security (Fixed-Income Securities Risk) with corresponding changes to the Fund’s value.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Foreside Fund Services, LLC, distributor.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on 500 market-capitalization-weighted widely held common stocks. The Russell 1000 Value Index refers to a composite of large and mid-cap companies located in the United States that also exhibit a value probability. The Russell 1000 Value is published and maintained by FTSE Russell. The Russell 1000® Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight - or 0.2% of the index total at each quarterly rebalance. IDC US Treasury 20+ Year Index (4PM), is a 4pm pricing variant of the ICE US Treasury 20+ Year Index, which is market value weighted and is designed to measure the performance of U.S. dollar-denominated, fixed rate securities with minimum term to maturity greater than twenty years. The Russell 2000 index is an index measuring the performance of approximately 2,000 smallest-cap American companies in the Russell 3000 Index, which is made up of 3,000 of the largest U.S. stocks. It is a market-cap weighted index. S&P US Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. The S&P SmallCap 600® seeks to measure the small-cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable. The Swiss Re CAT Bond Total Return Index is a non-investable index that tracks the total return of a representative basket of the global catastrophe bond market, excluding life and health catastrophe bonds and zero-coupon bonds. One cannot invest directly in an index or average.

Reshoring is the process of returning the production and manufacturing of goods back to the company's original country.

The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

The forward P/E ratio (or forward price-to-earnings ratio) divides the current share price of a company by the estimated future (“forward”) earnings per share (EPS) of that company. For valuation purposes, a forward P/E ratio is typically considered more relevant than a historical P/E ratio.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

The Energy Information Administration (EIA) is the statistical agency of the Department of Energy. It provides policy-independent data, forecasts, and analyses to promote sound policy making, efficient markets, and public understanding regarding energy, and its interaction with the economy and the environment.

As of 12/31/2023, the Fund’s top equity holdings were: Microsoft Corp. (6.7%); UnitedHealth Group Inc. (5.3%); Mastercard Inc. (4.9%); Kroger Co. (3.3%); Elevance Health Inc. (3.1%); Philip Morris International (3.0%); Visa, Inc. (2.8%); Merck & Co. Inc. New (2.7%); Bank of New York Mellon Corp (2.6%); Bank of America Corp (2.5%).

The views in this shareholder letter were those of the Fund Manager as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.